AI Features for SaaS: Yay or Nay?

In 2025, adding AI features to any digital product seems like a no-brainer. But is it really that obvious?

Over the last few months, we’ve had a lot of discovery work with our customers. A good part of that was ideation around new products. And if you’re considering starting a new digital product in 2025, an obvious question is: how should AI be involved?

Not whether. How.

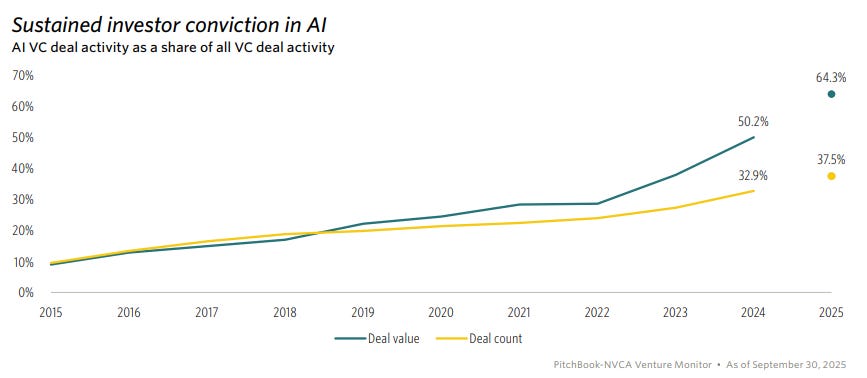

Investors’ conviction in AI doesn’t budge. As much as two-thirds of all funds go into AI startups. Sure, these numbers are distorted by massive deals such as OpenAI’s $40B Series F, or Thinking Machines Lab’s $2B seed round (to mention only the most striking outliers). Yet, everything else being the same, the path of least resistance to securing funding is to ideate a so-called AI-native startup.

Interestingly, still, most of the ideas we explore with our customers are candidates for a good old SaaS. A big question for them is whether they should aim to make their products AI-focused.

It’s one exploration path to assume that we consider only ideas centered around AI. It’s another one to treat AI as an option we use only when we believe it adds value.

“AI-Native” May Be a Limiting Constraint

A common message about the AI revolution is that we can now think of products that were unfathomable before. Some would say that the product development process, from ideation to product-market fit, should be redesigned around AI capabilities.

As the story goes, we now have more options.

And we do. We have all the new AI-based paths and all the old-school ones. Since Real Options tells us that options have value, we, as founders and product developers, are in a more advantageous place than we were before.

That is, unless we consciously resign from some of the available options. Stating up-front that we’re building an AI startup is precisely that. It’s like saying we will consider these new paths that the AI era has given us, but we will not use any of the old strategies (in a type of old-school SaaS).

Saying a product has to be AI-centered is thus a limiting factor. I’m not saying it automatically has to be bad or wrong. It’s just a voluntary resignation from some available paths.

Never Commit Early Unless You Know Why

One of the definitions of intelligence is that it’s a force that maximizes future options.

“Intelligence is a force that acts to maximize future freedom of action, or keep options open, with some strength, with the diversity of possible accessible futures, up to some future time horizon. In short, intelligence doesn’t like to get trapped.”

Alexander Wissner-Gross

If we ride this wave, giving up on non-AI-native solutions from the outset is unintelligent. That is not to say that there can’t be good reasons to do that. Circling back to Real Options, they tell us:

Options have value

Options expire

Never commit early unless you know why

The last bit is the most interesting here. We could rephrase “not considering old-school SaaS strategies” as “committing to an AI-native solution.” As is often the case, committing to one option makes some alternatives unavailable.

So there should always be a question about the why. There are potentially many sensible reasons why a founder might commit to an AI product, ranging from the relative availability of funding to attacking a niche where AI is the only sensible solution (think image generation). However, “Because everyone else is doing it” is not one of them.

Sadly, many founders skip that question. They just ride the hype wave and don’t even consider alternatives. They commit early without knowing why.

It’s Problem-Solution Fit, Not Solution-Problem Fit

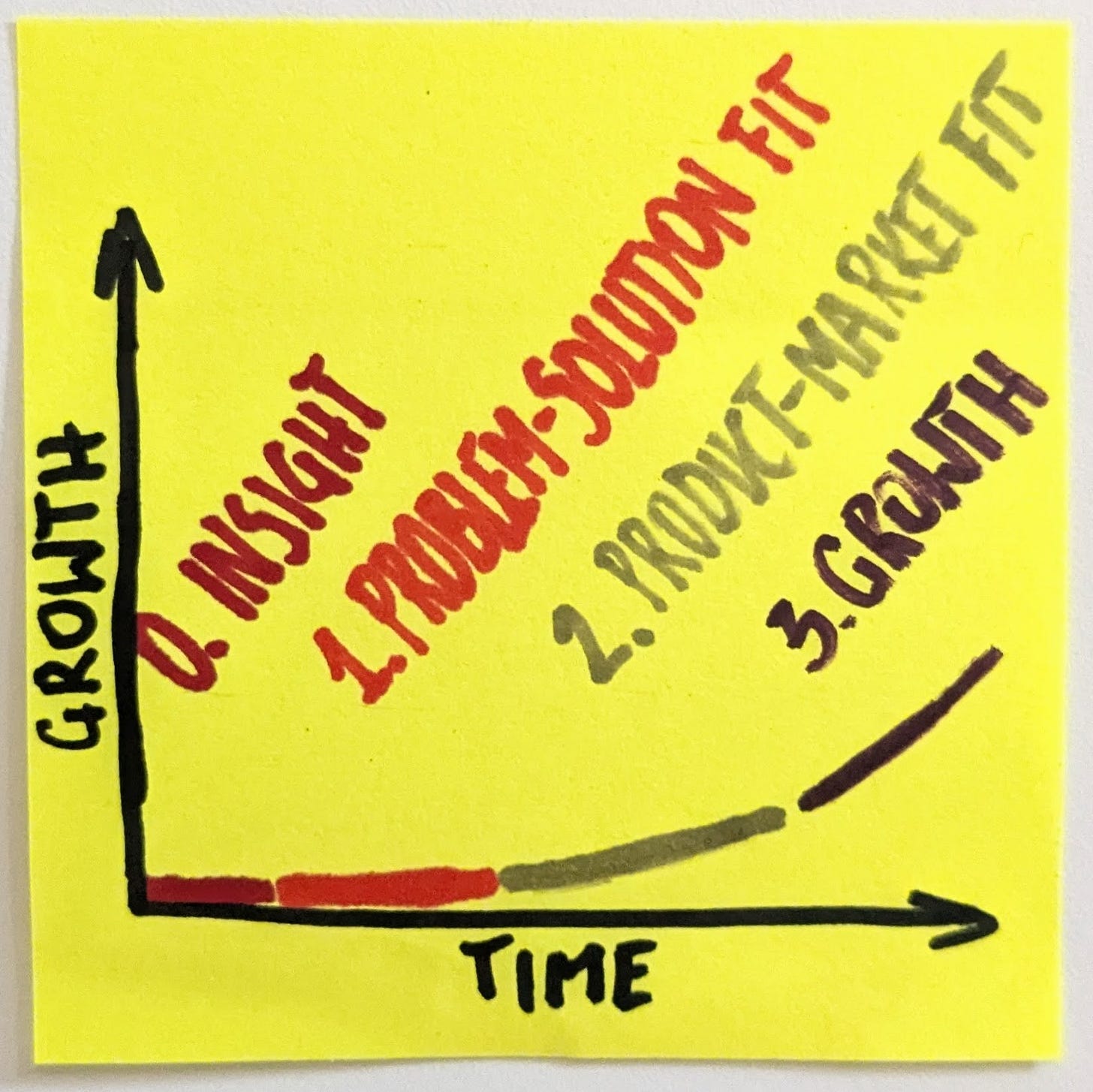

In the most basic startup growth model, the first tangible milestone after ideation is problem-solution fit.

It feels almost inappropriate to explain such basics here, but the basic pattern seems like this:

We identify an existing problem

We validate whether enough people actually have the problem

We propose a possible solution to the problem

We validate whether the solution actually solves the problem

Note the order. It’s the problem first, and the solution second. Saying “we’ll build an AI solution” from the get-go is turning the problem-solution fit on its head. Which, by the way, is what the IT was notoriously doing for decades.

“Build it, and they’ll come”—a common adage in the 2000s and beyond—epitomized the solution-first approach. The emergence and rise to prominence of Lean Startup in the 2010s is a good summary of how “well” the solution-centric approach worked.

When we’ve got this new shiny plaything (AI), we seem to have forgotten the old lessons. It feels a bit like the last two decades of knowledge progress in product development never happened.

It’s not called solution-problem fit. It’s a problem-solution fit for a reason. The problem should go first.

AI Didn’t Kill SaaS

There’s no shortage of buzz on AI killing, well, just about anything. SaaS, as the most common internet business model, can’t be out of that list, even if we consider only credible sources.

By the way, considering how AI affects the classic SaaS subscription model makes total sense. It is much more challenging to reach break-even with AI-centered products than with old-school SaaS. If anything, it’s an argument to keep the classic model an option, as well as AI-light implementations.

While usage-based pricing models will gradually dominate how we pay for software, SaaS will remain an attractive option for those who don’t heavily rely on AI. Customers will prefer the latter whenever they can get away with it.

Forgive stating the obvious, but unlimited is better than limited.

Does anyone miss the days when we had to pay for each call and text message we made on our mobile phones? Would anyone (old enough to remember) like to go back to when we dialed in to use the internet and paid for the time spent online?

By the same token, if we can now get unlimited service of a similar quality, we’d choose this alternative over an AI-native solution that necessarily has to charge us by use.

An option to use a service is, after all, an option. And we’ve already established that options have value (whether we exercise them or not). Thus, AI has not and will not kill SaaS.

AI Features: Yay or Nay?

Let’s go back to the original question. As a founder, how should I treat AI features?

Less-than-thrilling, but honest answer: treat AI features the same way as any other capabilities.

We don’t ask ourselves whether a product should have, say, real-time monitoring, an offline option, or a desktop application before we understand the problem and have an abstract idea for a solution. Save for some particular edge cases, we treat all these as options, but call for them only when relevant. Why should AI features be any different?

The classic product discovery pattern tells us to start in the problem space. Only once we validated that the problem actually exists do we move to exploring potential solutions. Each possible solution, be it AI-based or not, is an option.

It’s Real Options all over again. And remember, options have value.

In this very case, it does make sense to consider the value from different perspectives.

AI features have intrinsic value depending on the context

For example, having a meeting summary for a video call software is a useful feature for many. It’s not a core feature (video call is), but the synergy is obvious. When thinking about greenfield products, a valid alternative to list browsing and/or searching right now is a conversational AI-based chat interface. In each case, it makes sense to consider what value a specific solution offers.

AI affects product funding potential

The investment landscape is turbulent. Depending on who you listen to, you can hear that it’s difficult or better than ever. Or anything in between. One thing is clear, though. The investors have a heavy bias toward AI products. Enough AI features to turn a product into an AI-centered product, and your way to funding is easier.

AI affects exit scenarios

Corollary to the previous point, investors have less appetite for buying non-AI products companies, even if they show healthy numbers. As Kyle Poyar frames it: “There’s noticeably less interest in ‘good-not-great’ SaaS companies.” I might argue that selling is not the only option, but I know many founders treat it as a default path.

AI features cost per usage

Historically, once we added a feature to a product, there were no operational costs. With AI features, it’s not true anymore. We need to consider whether a feature would see relatively light usage, and thus we can “sponsor” it with subscription revenues (think: Zoom meeting notes). Or rather, will it go under heavy use, and you have to throttle its use (think: Grammarly delaying spellcheck until the author finishes the whole sentence/paragraph). We need to understand the expected usage pattern and how to gatekeep “expensive” functionalities.

AI features limit subscription plan options

For decades, we treated the availability of the free plan as a certainty. Upselling to the free tier was an important source of revenue for many product companies. Those were customers who knew the product, and, very often, there were many of them, too. With AI, the cost of maintaining the unpaid subscription is forbidding. That potentially affects the entire growth strategy.

To sum it up, it’s neither yay nor nay for AI features. Admittedly, because of the hype and exuberant infrastructure investments, there are more dimensions to consider than just a feature’s pure utility.

However, if the question about AI capabilities predates the question about the problem, we’re definitely doing it wrong. “Build it, and they’ll come” didn’t work 20 years ago, and it doesn’t work now. Even with AI.

I’m experimenting with a tool that confirms that this bit of content is handwritten (see the link below), especially since I used an em dash as well as the “it’s not this, it’s that” pattern.

I love the quote from Alexander Wissner-Gross...

One of the major CX SaaSs has recently implemented several AI features/services. In addition to the standard subscription fees for users (SMB/Enterprise), they will also incur costs based on the number of tokens used. Thus, they offset the cost risk and offer the tools that their clients want.

It seems like Yay for those who already have data and understand their clients' pains, and I can totally see how that is different for early-stage startups.

By the way, thanks for reminding me about Real Options.